New Silver is a superb selection for traders who are at ease with technological innovation, due to its speedy, AI-based loan acceptance process. Investors get instant online approval in only five minutes and close in as very little as five times.

Professional tip: A portfolio frequently gets a lot more challenging when it has much more investable assets. Remember to response this question to aid us connect you with the right Skilled.

A hard cash lender is a private organization or person that offers real-estate funding choices that normally aren’t obtainable through conventional property lenders. Their loans tend to be larger sized and have considerably less stringent eligibility criteria to get accepted.

Other search engines associate your advert-simply click actions by using a profile on you, which can be applied afterwards to target adverts to you on that internet search engine or about the web.

Within the competitive sphere of business assets offers, securing swift resources is often crucial. Hard funds loans facilitate this by bridging the gap with rapidly financing, underpinned by the industry value of the residence rather than the borrower’s credit score history. These loans typically element bigger once-a-year percentage prices but can provide important pros, which include The chance for property fairness loans from the enhanced benefit post-buy.

Prior to delving into a hard revenue loan, It truly is paramount that traders rigorously Assess curiosity premiums together with other involved expenditures to ensure the money practicality with the enterprise. Assessments of loan-to-value ratios and fairness choices are integral to determining the collateral adequacy on an asset, be it household or professional.

A further distinction between hard money lenders and P2P lenders is lender in no way personally interacts with the borrower inside a P2P loan. The lending System mediates the transaction and will make guaranteed all the things is finished on above board.

State regulations for hard cash lending range and may include things like licensing specifications, fascination price caps, and disclosure necessities.

As you investigation your choices for your hard income loan, it’s crucial that you Assess eligibility requirements, expenditures and loan terms to make sure you locate the very best fit in your case.

We use details-driven methodologies to evaluate economical products and corporations, so all click here are measured equally. You are able to browse more about our editorial pointers and the mortgages methodology with the scores beneath.

This can be done as the price of home is checked towards intensive credit score checks with money documentation, and for this reason, it can be employed finest in urgent housing transactions.

We provide hyperlinks to external Web sites for usefulness. Herring Bank doesn't endorse and isn't chargeable for their information, inbound links, privateness or stability policies.

How to Do a Comparative Current market Assessment: A Step-by-Phase Manual Conducting exact, constant property valuations isn’t effortless, and many agents aren’t taught this ability in their real-estate lessons. We’ll walk you with the overall method and offer you a template to get you commenced.

FHA loans are insured because of the Federal Housing Administration and commonly have decrease interest fees. Since FHA loans have much more adaptable loan demands and are backed through the federal authorities, lenders can give these loans to borrowers who could have struggled to meet typical loan specifications.

Ben Savage Then & Now!

Ben Savage Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Charlie Korsmo Then & Now!

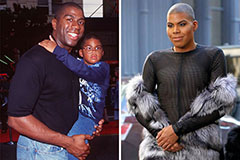

Charlie Korsmo Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!